does massachusetts have an estate or inheritance tax

Those who own an estate worth less than that amount will not owe taxes on it but in the case of a couple who owns assets including real estate in Massachusetts that are valued above 1 million the surviving spouse will be subject to MA estate taxes upon his or her death. Tennessee does not have an estate tax.

Retiring In These States Will Cost You More Money Vision Retirement

Future changes to the federal estate tax law have no impact on the Massachusetts estate tax.

. A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. Massachusetts has an estate tax but not an inheritance tax. Eleven states have only an estate tax.

The federal estate tax by comparison maxes out at 40 percent. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. If you owe the Massachusetts estate tax almost all of your estate will be taxed.

Currently the Massachusetts Estate Tax Exemption is 1 million. Twelve states and Washington DC. The Massachusetts estate tax exemption is 1M.

The Massachusetts Department of Revenue says that you have to file an estate tax return and pay estate tax if the gross estate exceeds 1 million including adjusted taxable gifts. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000. All printable Massachusetts tax forms are in PDF.

Massachusetts and Oregon have the lowest exemption levels at 1 million and. However this estate tax only applies to estates valued over 1 million. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary.

Massachusetts doesnt have an inheritance tax. Some states will levy an inheritance tax regardless of where the beneficiary or heir lives. The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more.

Massachusetts and Oregon have the lowest exemption levels at 1 million and New York has the highest exemption level at 59 million. Fortunately Massachusetts does not levy an inheritance tax. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

When you die if your estate is valued at 1M or under you pay no estate tax. Maryland is the only state to impose both. It also does not have a gift tax.

Technically Tennessee residents dont have to pay the inheritance tax. If you want to get around paying estate tax to the state of Massachusetts youll have to get your. The Massachusetts estate tax would be about 900000 if you were a resident of the Commonwealth at your death.

The rate ranges from 8 to 16. Computation of the credit for state death taxes for Massachusetts estate tax purposes. If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax.

Massachusetts does have an estate tax but the estate is exempt from this tax unless the estate is over 1000000. Even when the gross estate is less than 1 million a Massachusetts estate tax may still be owed if enough taxable gifts were made during lifetime so that the sum of the gross estate and the. Massachusetts imposes an estate tax on all estates with assets of more than 1 million.

But if you inherit money or assets from someone who lived in another state make sure you verify state law. The Massachusetts estate tax was decoupled from the federal estate tax beginning with deaths occurring in 2003. Tennessee is not impose an estate tax.

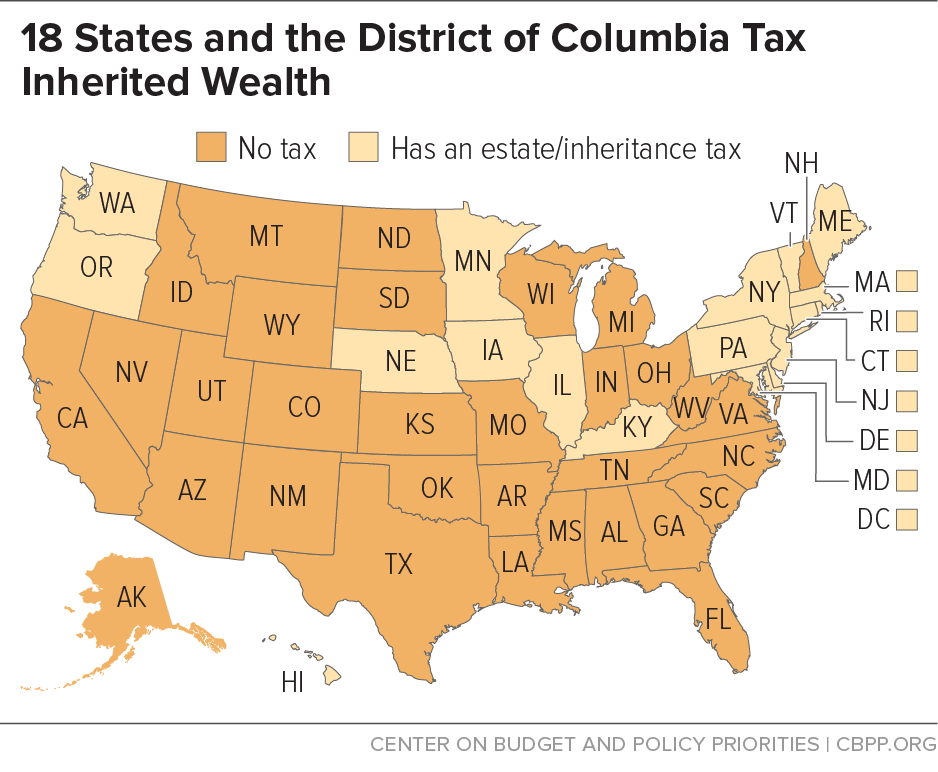

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. Making large gifts over 15000 per year per person in 2018 will likely. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

Eleven states have only an estate tax. Here are a few. Also the Massachusetts estate tax has a regressive.

About a third of your estate is in Massachusetts. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Impose estate taxes and six impose inheritance taxes. The estate tax is a tax paid by the estate of a deceased person if the taxable assets areworth more than a set threshold amount 1 million in Massachusetts.

Massachusetts doesnt have an inheritance tax but some residents of Massachusetts and nonresidents with property in the state will find it can be an expensive. Massachusetts residents face a multitude of taxes. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000.

Connecticut Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island Vermont and Washington. If youre responsible for the estate of someone who died you may need to file an estate tax return. The Massachusetts taxable estate is 940000 990000 less 50000.

Massachusetts doesnt have an inheritance tax but some residents of Massachusetts and nonresidents with property in the state will find it can be an expensive. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The good news.

Massachusetts doesnt have an inheritance tax but some residents of Massachusetts and nonresidents with property in the state will find it can be an expensive state for your heirs to inherit your property as it employs its own estate tax. If youre inheriting assets from another state the first thing to do is to check the will or trust to see if they address how inheritance taxes will be paid. For context an estate with an adjusted taxable value of 1 million would be taxed at 56 percent.

Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31 2000. If it is valued at one dollar over 1M your estate is taxed on the ENTIRE amount not just the amount that is over.

However if youre inheriting money from someone who lived out of state you need to check the laws of that state. So with a third of your estate being in Massachusetts the tax would be a.

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

What Are Estate And Gift Taxes And How Do They Work

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate Tax Everything You Need To Know Smartasset

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Estate Law And Wills What Is The Date On Which A Property Is Considered Inherited For Us Irs Tax Purposes Quora

State Estate And Inheritance Taxes Itep

Estate Tax In Massachusetts Slnlaw

States Should Retain Their Estate Taxes Center On Budget And Policy Priorities

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

What Is An Estate Tax Napkin Finance

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington