tax on unrealized gains uk

Add this amount to your taxable income. But taking the 8000 loss and reporting a net.

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

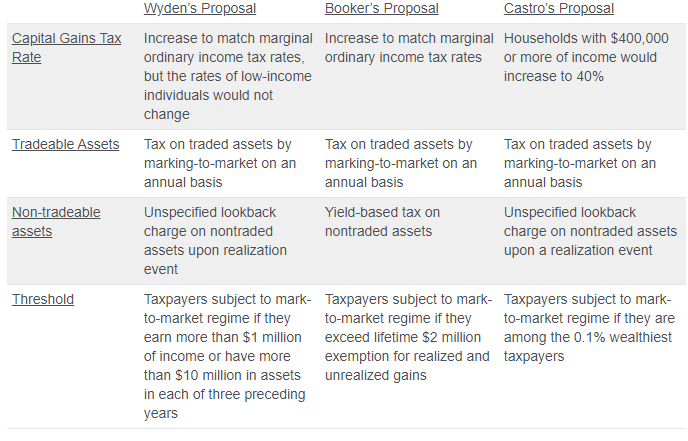

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. To increase their effective tax rate. This means you dont have to report them on your annual tax return.

The way its currently structured the tax would affect the richest 700 Americans forcing them to include unrealized gains as part of their annual income. How are capital gains taxed in UK. A UK resident company is taxed on its worldwide total profits.

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. Unrealized gains are not taxed by the IRS.

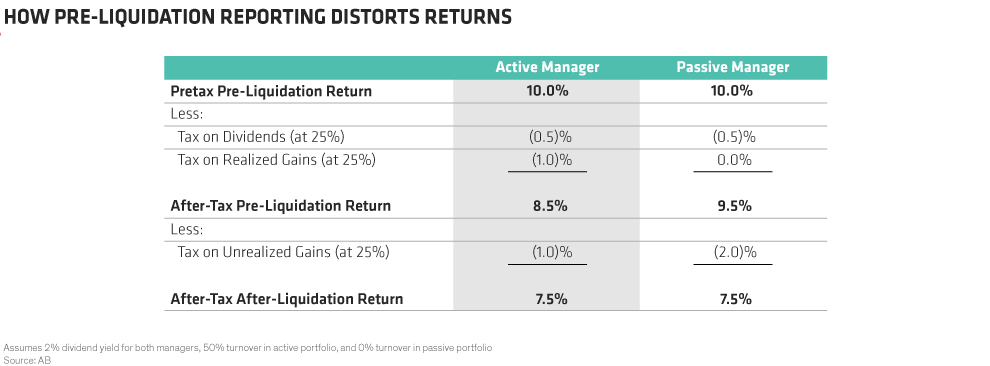

If you decide to sell youd now have 14 in realized capital gains. There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Last reviewed - 27 July 2022. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Work out your total taxable gains.

For example you buy a stock at 10 per share and the trading price rises to 15 per share. Your investment account balance will reflect the change but because you havent sold. Corporate - Income determination.

Work out your total taxable gains. 1 day agoAssuming she has a marginal income tax rate of 27 24 federal plus 3 state the 10000 gain would cost her 2700 in taxes. Deduct your tax-free allowance from your total taxable gains.

Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law capital gains exclusion of 250000500000 for primary. How are capital gains taxed in UK. 6 hours agoBut a mini-budget that she and Kwarteng unveiled three weeks ago which promised 45 billion pounds 50 billion in tax cuts without explaining how the government.

The EU Anti-Tax Avoidance Directive 20161164 the ATAD into the Polish legal system. Capital gains are only taxed if they are realized which means. Add this amount to your taxable income.

The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices if. Deduct your tax-free allowance from your total taxable gains. For example if you were ahead of the curve and bought bitcoin for 100 and.

EXIT TAX According to the draft Amendment the tax on income from unrealised gains should be. Below are one economists estimates of what the top 10 wealthiest. Total profits are the aggregate of i the.

Tax Systems Of Scandinavian Countries Tax Foundation

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

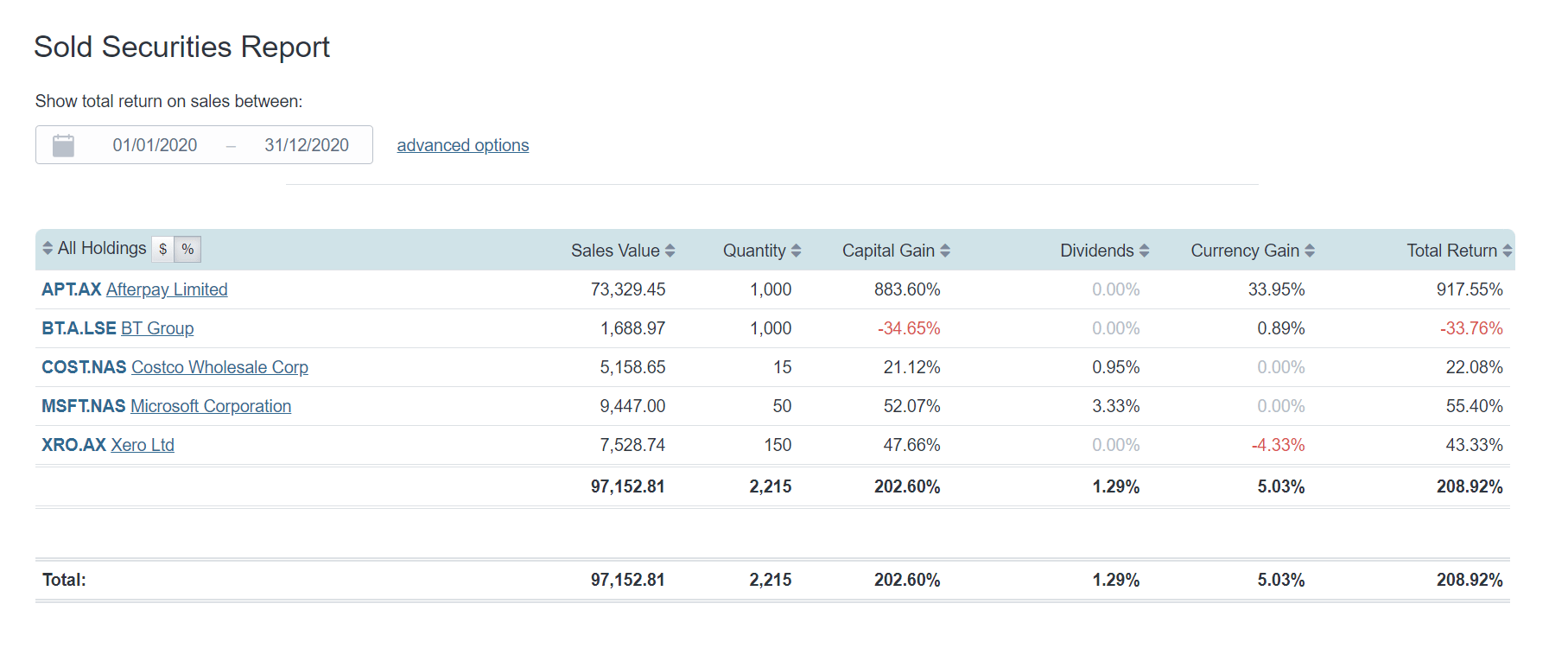

Investment Portfolio Tax Reporting Sharesight Uk

Vita Coco Files For Ipo Nasdaq Coco Seeking Alpha

High Income Taxpayers Progressivity And Inequality Tax Foundation

Democratic Tax Policy Proposals Lexology

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Income Tax Law Changes What Advisors Need To Know

Capital Gains Yield Cgy Formula Calculation Example And Guide

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Crypto Tax Loss Harvesting Investor S Guide Koinly

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

Capital Gain Definition Types Corporate Tax Rates Example

Capital Gains Tax Individuals Part 2 Acca Taxation Tx Uk Youtube

China Taxation Of Cross Border M A Kpmg Global

How To Optimize Your Investments For Skat Saving Taxes In Denmark Your Green Wealth